Does the new GLP-1 market follow brand laws?

Like, when a new category pops the world, does it follow brand laws, or is it wonky?

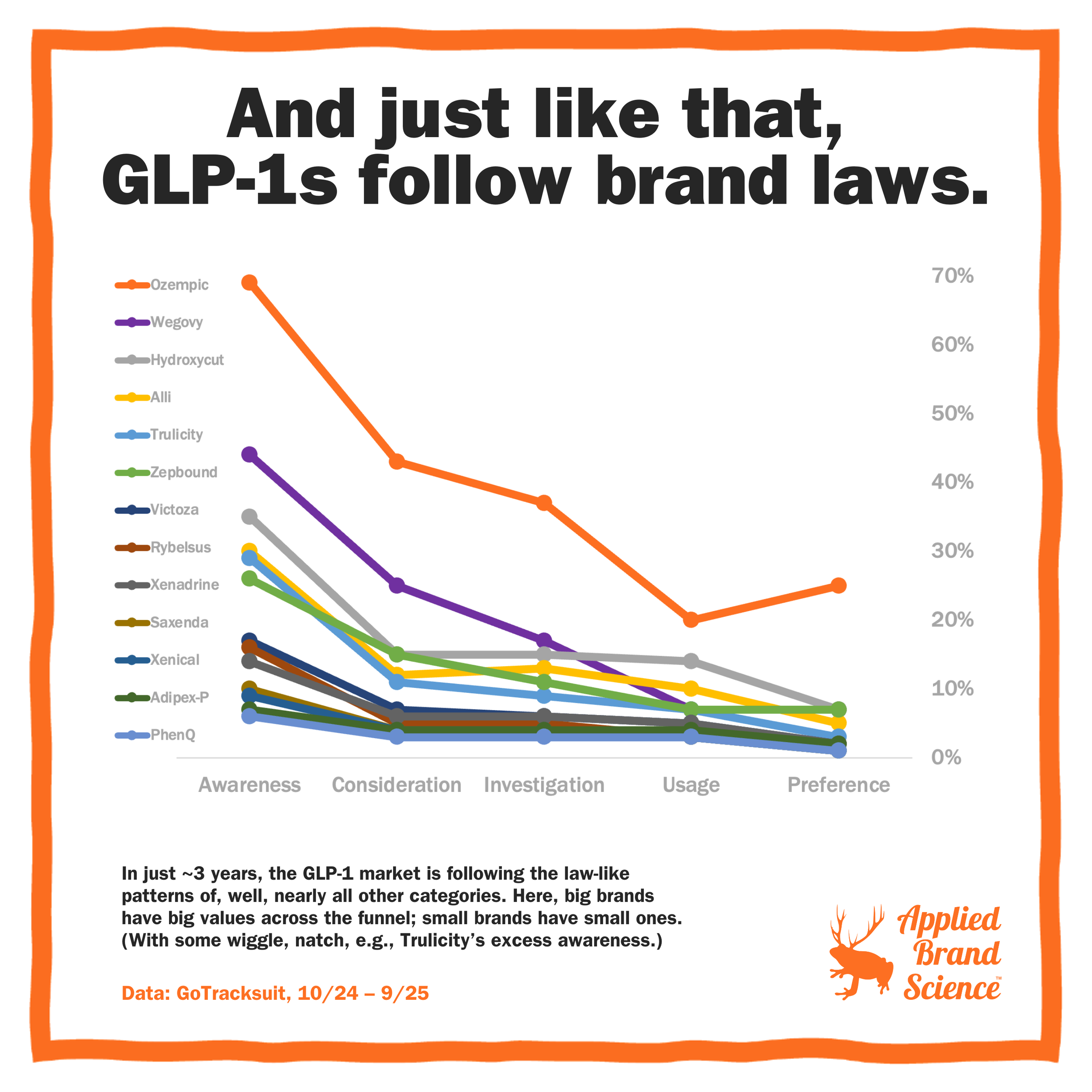

My friends at Tracksuit helped answer this with some lovely purchase funnel data on the GLP-1 market in the US from the past year. They tracked 13 brands, from Ozempic down to PhenQ (I've never heard of it either), and surveyed 9,300 people in the US.

Aaaand, sure enough, after only 3-ish years, the GLP-1 category seems to be following brand laws.

In this case, big brands like Ozempic & Wegovy have higher everything across the purchase funnel (awareness, consideration, investigation, usage, and purchase). And tiny brands like Adipex-P and PhenQ have tiny things.

(This checks out with market share data: Ozempic has 31% of the market, Wegovy has 16%, and the little ones have, uh, about 1%.)

Is there wiggle? Of course. Ozempic has lower awareness & higher preference than you'd expect. Trulicity's awareness is 5% higher than you'd expect. And Wegovy's consideration is a bit lower than you'd expect.

Some lessons:

🔸 Brand laws are hard to shake.

🔸 Compare your brand to the expectations for a brand of your size, not to category averages.

🔸 The wiggle tells you something else is happening.