How Does Market Share Influence Profits?

Does it at all?

“Common sense” is that gaining market share helps a firm gain economies of scale. And that efficiency turns into better margins.

Buuuut the data tell a different story.

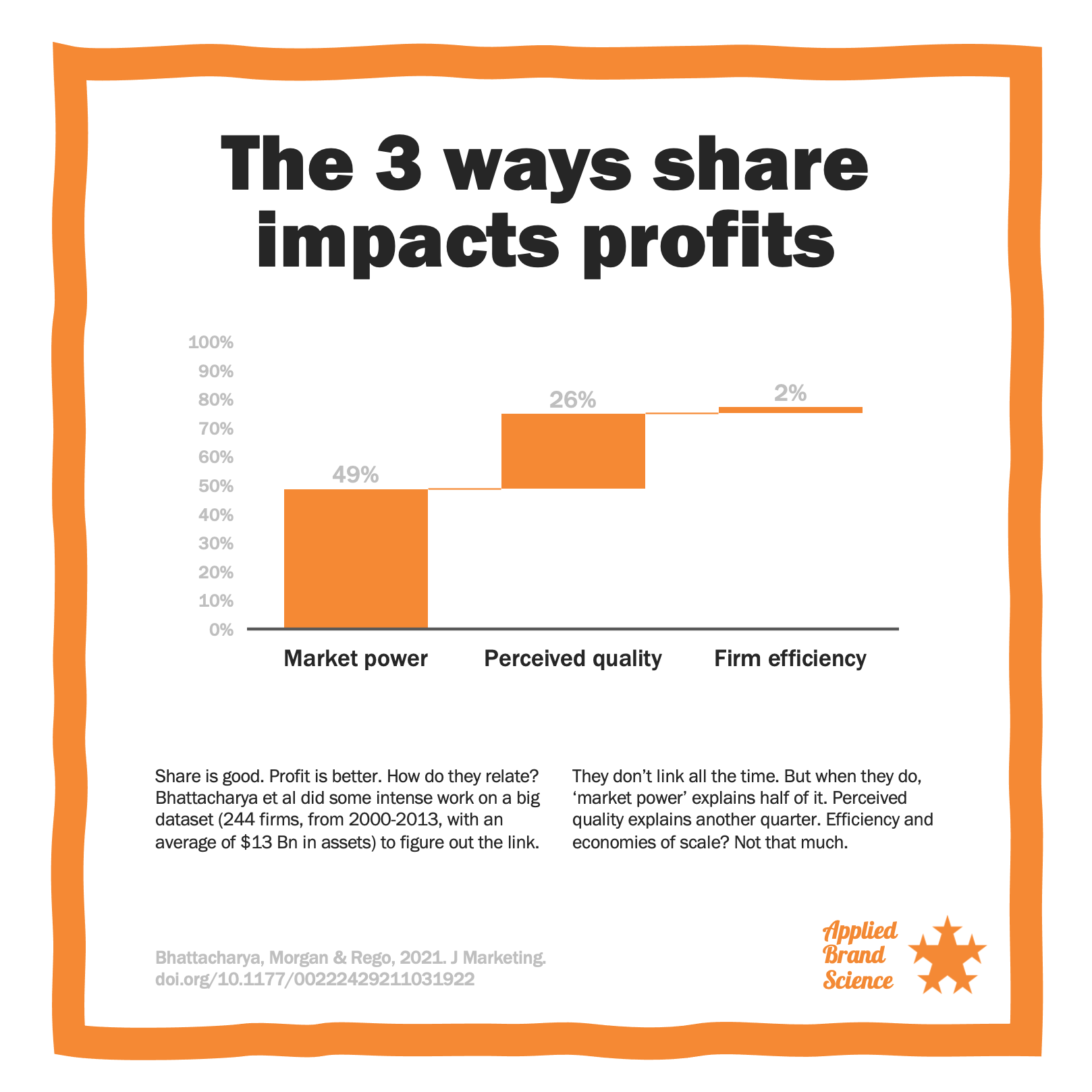

Bhattacharya et al did some intense work on a big dataset to find out. They crunched numbers on 244 firms, with an average of $13 Bn in assets, from 2000-2013.

First of all, share and profit don’t link all the time. They can move quite independently.

But when they do link, ‘market power’ is HALF of the connection. This is primarily the ability to charge a higher price — thus increase profits (natch). But it’s also from getting better prices from suppliers.

Perceived quality explains another quarter of the impact: a brand with more shelf space just ‘seems’ like it must be better, thus commanding better margins.

Efficiency and economies of scale? Not that much. A whopping TWO percent.

So if you’re able to increase share, or if you have a dominant market position, it should give you the power to boost prices, negotiate better rates from suppliers, and increase your margins.