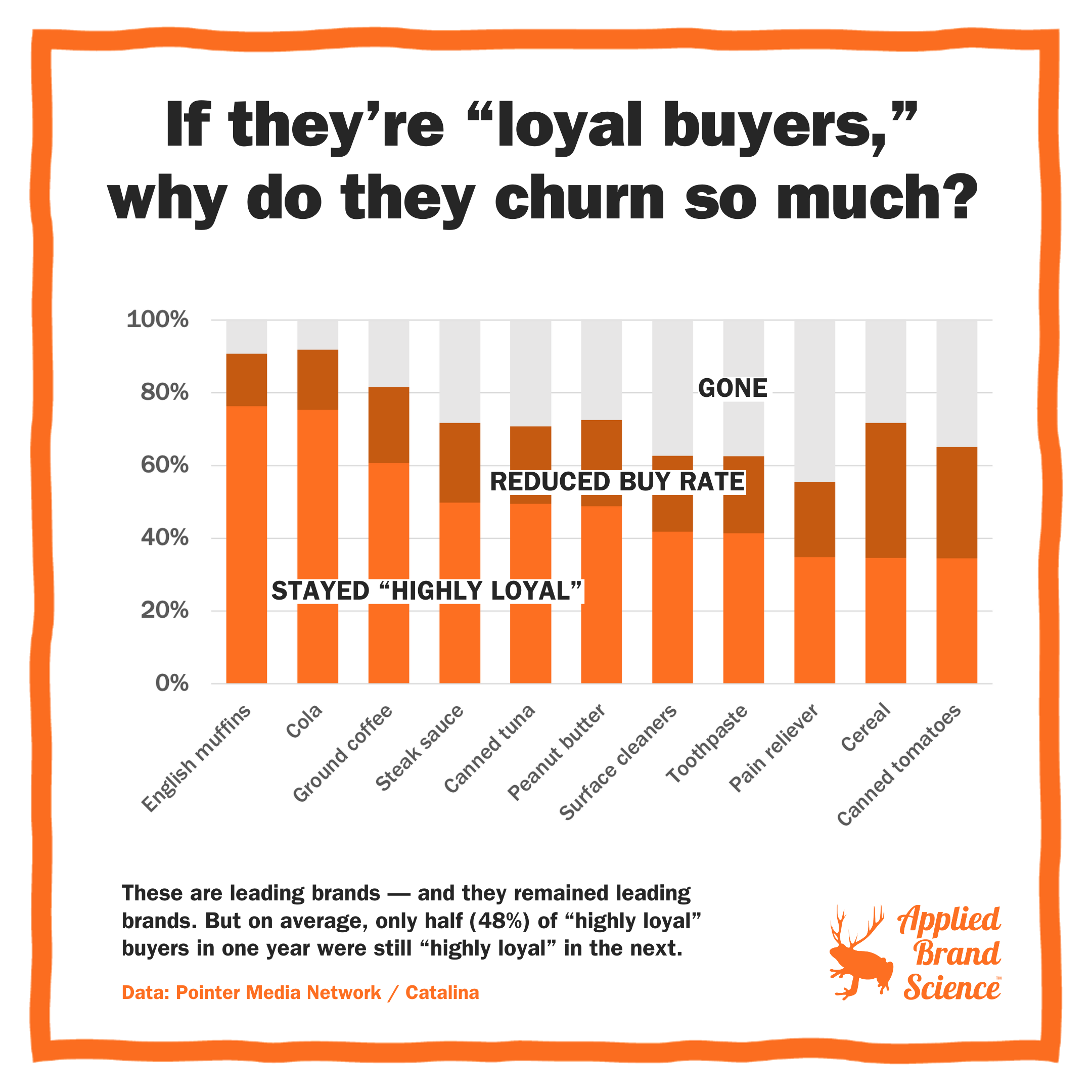

If they’re “loyal buyers”, why do they churn so much?

A few years ago, Pointer Media looked at the actual purchases of 32MM people across 658 leading brands in the US. Then they checked out whether “highly loyal” customers in one year (let’s call them HLCs) were still highly loyal in the next year.

They found what looked like a paradox: most brands, including the leading brands in each category, had TONS of churn in their HLCs. And yet market share changed very little.

On average, 48% of HLCs in year one were still HLCs the next year. 19% reduced their buying of the brand. And 33% — one third! — didn’t buy the brand at all. Cola brands retained 76% of HLCs, but cereal? Only 35%. Yowza!

But if market share is barely changing, what the heck’s going on?

Well, a few things, actually:

1. HLCs were defined as people who spent 70% of their category dollars on a single brand. But that could be someone who bought 4 items total that year (3 from one brand) or 40.

2. The time window was one year. This *seems* like enough time to get a read on someone’s behavior. But actually, even for these staples, it might be way too short. See, people regularly buy 2 or 3 brands in a category & switch them up kinda at random. So they’re “defecting” to another brand in their repertoire.

3. Aaaaand they measured loyalty to a *product*, not to a total brand. So an HLC could’ve “defected” from Crest to…. Crest.

Some key lessons for us all:

🔸 Lots of these “crises” are really due to measuring the wrong things, or measuring them in the wrong way. So step 1 is, always know what the heck you’re actually measuring.

🔸 “Loyalty” is a craptastically sloppy word. Use “share of wallet”, or “buy rate”, or “heavy buyers”.

🔸 Know the brand science! Then you’ll understand all these dynamics and not get spooked by the wrong things. (And you’ll learn how to grow.)