How Valuable is Your “Brand”?

It’s gotta be more than just your revenue, or your market cap. But how do you measure it? Is it $10M or $10B?

Interbrand just released their latest list of the best global brands. Their formula is “financial performance” + “the role the brand plays in purchase decisions” + “the brand’s competitive strength AND its ability to create loyalty.” (Ital mine because confused.) It’s a secret sauce, but it does meet ISO standards.

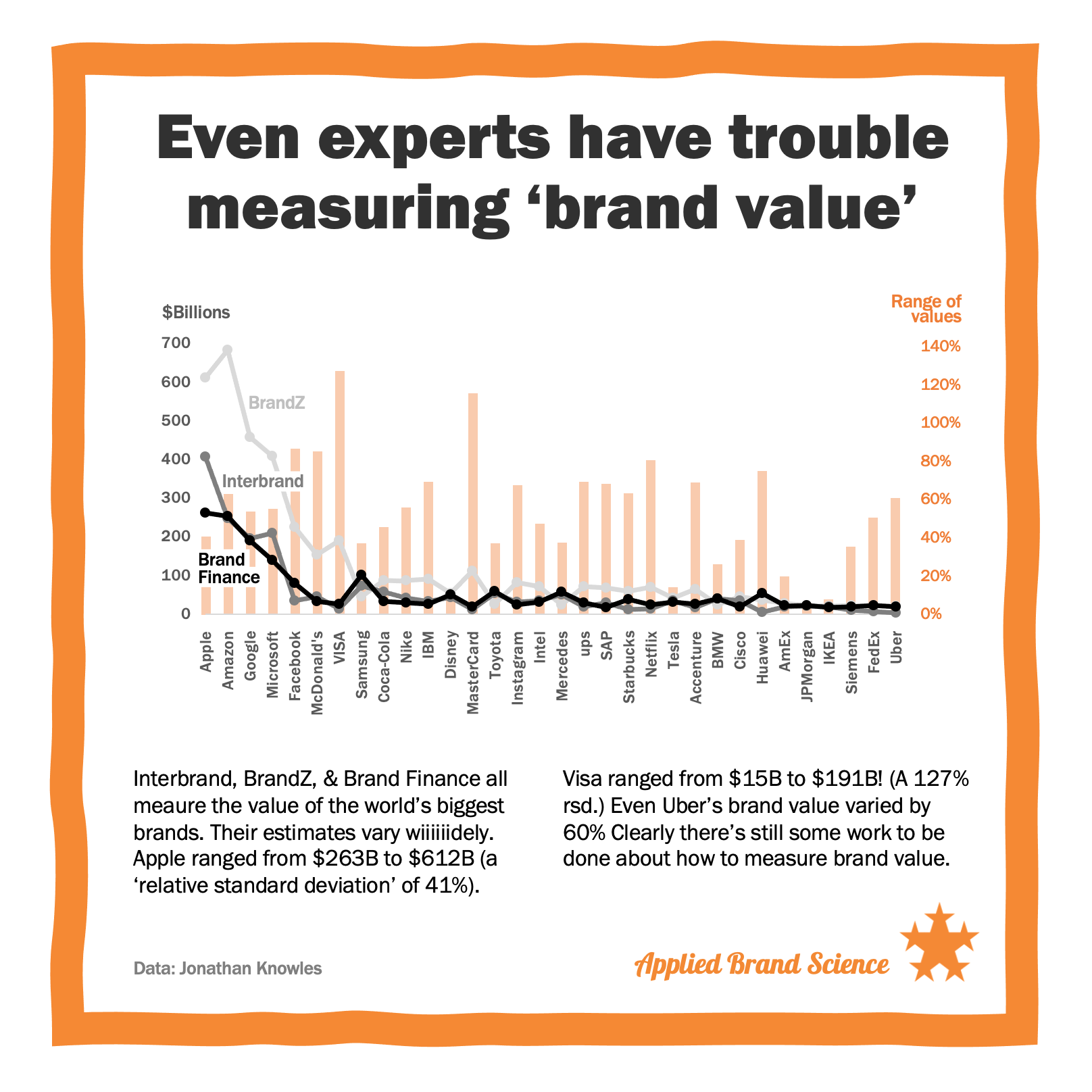

BrandZ and Brand Finance have their own methods. Jonathan Knowles was kind enough to gather the data for all three.

Overall, they mostly agree on the ranking of the world’s strongest brands. Whew.

But they disagree quite a bit on the dollar values.

Apple’s value ranged from $263Bn to $612Bn (a "relative standard deviation" of 41%).

Visa ranged from $15Bn to $191Bn — a 127% rsd. MasterCard wasn’t much better.

Even “little” Uber’s brand value varied by 60%.

On the other end, JPMorgan (6%) and Ikea (8%) had the most agreement.

In fact, the average rsd is 45% (kinda like Apple). That's huuge.

But I don’t blame them. I mean, it’s indisputable that a brand is more than just the factories, or revenue, or product. And it’s gotta be more concrete than just “how consumers feeeeel about you.”

A strong brand also does all kinds of wondrous things: pricing power, excess repeat purchase, more mental availability, more leverage with suppliers, attracting better talent, attracting investment, increased ad effectiveness, more media coverage, cumulative advantage, etc. Strong brands rule!

But putting a precise dollar value on that is a bitch. Clearly.

So kudos to Interbrand & BrandZ & Brand Finance for trying.